Try It Now

Calculate Your Import Tariffs

Get started with our comprehensive tariff calculator. Search for your product and calculate all applicable tariffs.

Calculate Complex U.S. Import Tariffs with Confidence

Built by U.S. Customs and international trade lawyers, Tariff Tally helps you accurately calculate tariffs by considering all applicable tariffs, including PNTR, Section 201, 232, 301, IEEPA, and AD/CVD duty rates. Get precise tariff estimates in seconds.

Accurate U.S. Tariff Calculations

Everything you need to calculate United States import tariffs

Tariff Tally handles all types of tariffs and special cases, ensuring you get accurate tariff estimates every time.

- Comprehensive Tariff Coverage

Handles all major tariff types including Permanent Normal Trade Relations (PNTR), Section 201, 232, 301, IEEPA, and AD/CVD duty rates. Our system automatically applies the correct rates based on your product and country of origin.

- Special Cases & Exclusions

Automatically handles special cases like country-specific exclusions, U.S. content provisions, and PNTR benefits. Get accurate calculations that consider all applicable rules.

- AI-Powered HTS Search

Find the right product classification with our AI-powered HTS code search. Our intelligent search helps you understand trade classifications and find the correct codes faster than ever.

See It In Action

Powerful HTS search & comprehensive tariff calculations

Our platform provides everything you need to find the right HTS codes and calculate accurate tariffs.

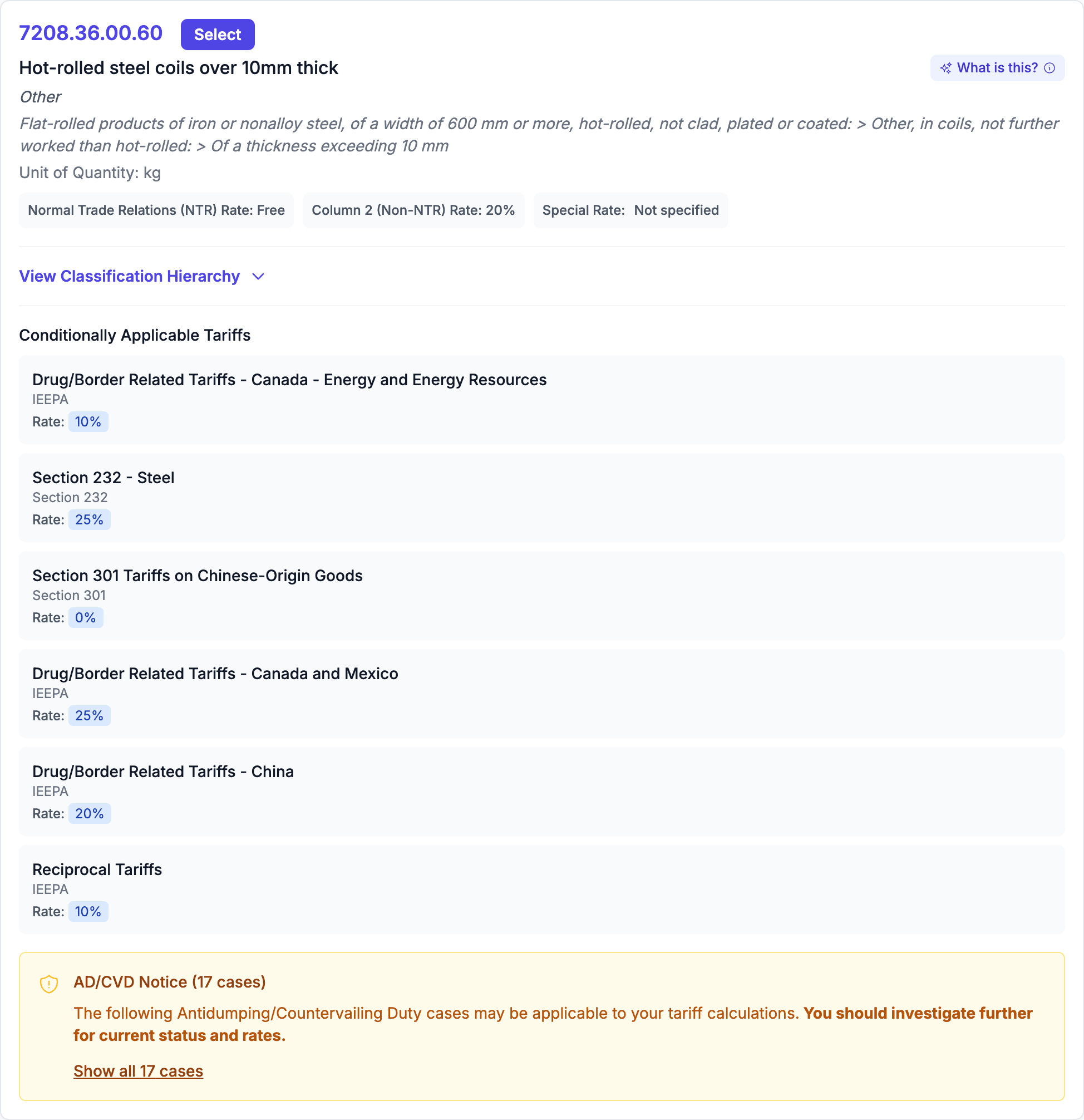

AI-Powered HTS Code Search

Find HTS codes quickly with our intelligent search. Get AI-generated descriptions that help you understand product classifications, view conditionally applicable tariffs that might apply to your goods, and see relevant AD/CVD (Anti-Dumping and Countervailing Duty) orders that could affect your imports.

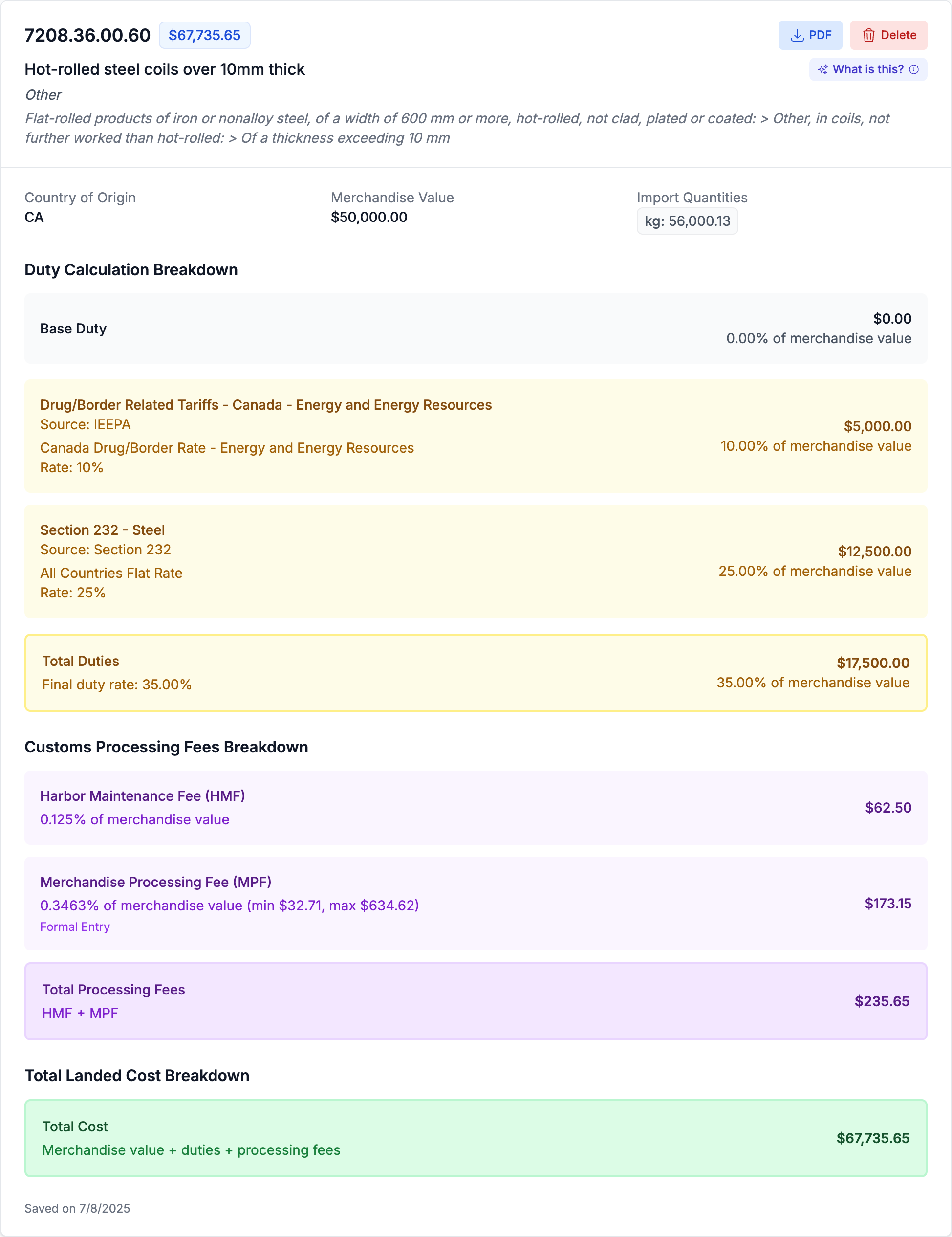

Comprehensive Tariff Calculations

Generate a complete breakdown of duty rates, all applicable tariffs (including PNTR, Section 201, 232, 301, IEEPA, and AD/CVD), total duties owed, customs processing fees, and a detailed total landed cost breakdown. This comprehensive output gives you everything you need to understand your import costs.

Start Calculating Tariffs Today

Join importers who trust Tariff Tally for accurate tariff calculations.

Tariff rates are approximate, subject to change, and provided for informational purposes only. Always take care to verify any applicable tariff rates with a Customs attorney, licensed Customs broker, or using official CBP resources.